The concept of elasticity is a fundamental principle in economics, measuring the responsiveness of the quantity demanded or supplied of a good to changes in its price or other influential factors. Understanding elasticity is crucial for businesses, policymakers, and economists to predict the effects of price changes, taxes, or other external factors on the market. There are several methods to calculate elasticity, each serving a specific purpose and offering unique insights into market behavior. Here, we explore five ways to calculate elasticity, highlighting their applications, formulas, and interpretations.

Key Points

- Price elasticity of demand measures how responsive the quantity demanded of a good is to changes in its price.

- Income elasticity of demand assesses the responsiveness of quantity demanded to changes in consumer income.

- Cross-price elasticity of demand examines the relationship between the quantity demanded of one good and the price of another good.

- Price elasticity of supply analyzes how the quantity supplied of a good reacts to changes in its price.

- Advertising elasticity of demand evaluates the impact of advertising expenditures on the quantity demanded of a product.

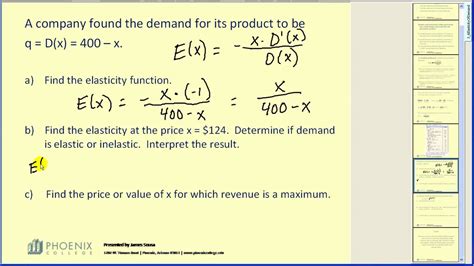

Price Elasticity of Demand

The price elasticity of demand is one of the most commonly calculated elasticities, as it directly informs pricing strategies. It is calculated using the formula: Ed = (ΔQd / Qd) / (ΔP / P), where Ed is the price elasticity of demand, ΔQd is the change in quantity demanded, Qd is the original quantity demanded, ΔP is the change in price, and P is the original price. A result greater than 1 indicates elastic demand, meaning quantity demanded changes significantly with price changes. A result less than 1 suggests inelastic demand, where quantity demanded is less responsive to price changes.

Interpretation of Price Elasticity

The interpretation of price elasticity is crucial for businesses. For products with elastic demand, price increases may lead to significant decreases in quantity demanded, potentially reducing total revenue. Conversely, for products with inelastic demand, price increases may result in increased total revenue, as the decrease in quantity demanded is proportionally less than the price increase.

Income Elasticity of Demand

Income elasticity of demand measures how the quantity demanded of a good changes in response to changes in consumer income. It is calculated as: Ei = (ΔQd / Qd) / (ΔI / I), where Ei is the income elasticity of demand, ΔQd is the change in quantity demanded, Qd is the original quantity demanded, ΔI is the change in income, and I is the original income. A positive income elasticity indicates a normal good, where demand increases with income. A negative income elasticity signifies an inferior good, where demand decreases as income increases.

Applications of Income Elasticity

Understanding income elasticity is vital for forecasting demand based on economic conditions. During economic downturns, products with high income elasticity may experience reduced demand, while products with low or negative income elasticity may see more stable or even increased demand.

Cross-Price Elasticity of Demand

Cross-price elasticity of demand measures the responsiveness of the quantity demanded of one good to a change in the price of another good. It is calculated as: Exy = (ΔQx / Qx) / (ΔPy / Py), where Exy is the cross-price elasticity of demand, ΔQx is the change in quantity demanded of good X, Qx is the original quantity demanded of good X, ΔPy is the change in price of good Y, and Py is the original price of good Y. A positive cross-price elasticity indicates that the two goods are substitutes, while a negative cross-price elasticity suggests they are complements.

| Category of Goods | Cross-Price Elasticity Interpretation |

|---|---|

| Substitutes | Positive cross-price elasticity, as increase in price of one good increases demand for the other. |

| Complements | Negative cross-price elasticity, as increase in price of one good decreases demand for the other. |

Price Elasticity of Supply

The price elasticity of supply measures the responsiveness of the quantity supplied of a good to changes in its price. It is calculated using the formula: Es = (ΔQs / Qs) / (ΔP / P), where Es is the price elasticity of supply, ΔQs is the change in quantity supplied, Qs is the original quantity supplied, ΔP is the change in price, and P is the original price. A price elasticity of supply greater than 1 indicates elastic supply, where quantity supplied changes significantly with price changes. A price elasticity of supply less than 1 suggests inelastic supply.

Factors Influencing Supply Elasticity

The elasticity of supply can be influenced by several factors, including production costs, technology, and the time period considered. Businesses with variable costs that are highly sensitive to output levels may exhibit more elastic supply, as they can quickly adjust production in response to price changes.

Advertising Elasticity of Demand

Advertising elasticity of demand assesses how responsive the quantity demanded of a product is to changes in advertising expenditures. It is calculated as: Ea = (ΔQd / Qd) / (ΔA / A), where Ea is the advertising elasticity of demand, ΔQd is the change in quantity demanded, Qd is the original quantity demanded, ΔA is the change in advertising expenditures, and A is the original advertising expenditure. A positive advertising elasticity indicates that advertising is effective in increasing demand.

What is the significance of calculating elasticity in economics?

+Calculating elasticity is significant because it helps in understanding how responsive the quantity demanded or supplied of a good is to changes in its price or other factors, thereby informing pricing strategies, predicting demand, and making policy decisions.

How does the concept of elasticity apply to real-world scenarios?

+In real-world scenarios, elasticity applies to various aspects such as pricing strategies of businesses, taxation policies of governments, and understanding consumer behavior. For instance, a company might use price elasticity of demand to determine the optimal price for its products, while a government might consider the elasticity of demand for a product when deciding on tax rates.

What are the limitations of elasticity calculations?

+The limitations of elasticity calculations include assumptions of ceteris paribus (all other things being equal), which may not always hold true in real-world scenarios. Additionally, elasticity can vary over time and may be influenced by numerous factors, making it challenging to accurately predict market behavior solely based on elasticity calculations.