Florida, known for its beautiful beaches and vibrant cities, is a popular destination for individuals and families alike. When it comes to managing finances, understanding the intricacies of paycheck calculation is crucial for residents and employers. The Florida paycheck calculator is a tool designed to simplify the process of calculating take-home pay, considering various factors such as gross income, deductions, and taxes. In this article, we will delve into the world of paycheck calculation, exploring the top 5 ways a Florida paycheck calculator can assist individuals and businesses in navigating the complexities of payroll management.

Key Points

- Understanding the importance of accurate paycheck calculation for both employees and employers

- Utilizing a Florida paycheck calculator to account for state and federal taxes

- Considering deductions such as health insurance and 401(k) contributions

- Recognizing the role of payroll frequency in calculating take-home pay

- Applying a paycheck calculator to make informed financial decisions

Navigating Paycheck Calculation with a Florida Paycheck Calculator

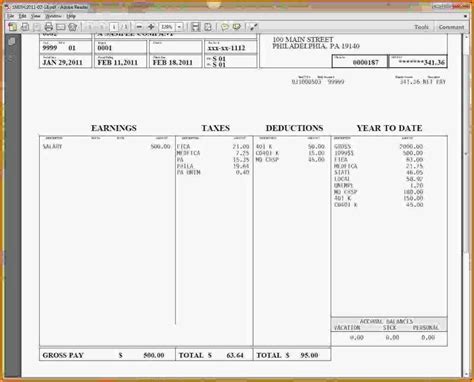

A paycheck calculator specifically designed for Florida takes into account the state’s tax laws and regulations, ensuring that calculations are accurate and compliant. One of the primary ways a Florida paycheck calculator assists users is by providing a clear breakdown of their take-home pay, factoring in gross income, taxes, and deductions. For instance, if an individual has a gross income of $50,000 per year, the calculator would subtract federal and state taxes, as well as any deductions the individual may have, such as health insurance premiums or retirement contributions, to arrive at the net income.

Calculating Taxes with Precision

Taxes play a significant role in paycheck calculation, and a Florida paycheck calculator is equipped to handle both federal and state taxes. Florida is one of the few states with no state income tax, which simplifies the calculation process for residents. However, federal taxes still apply, and the calculator ensures that these are accurately deducted. For example, using the 2022 federal income tax brackets, an individual with a taxable income of $40,000 would fall into the 12% tax bracket, with the calculator applying the appropriate tax rate to determine the federal tax liability.

| Taxable Income | Federal Tax Rate |

|---|---|

| $0 - $9,875 | 10% |

| $9,876 - $40,125 | 12% |

| $40,126 - $80,250 | 22% |

| $80,251 - $164,700 | 24% |

| $164,701 - $214,700 | 32% |

| $214,701 - $518,400 | 35% |

| $518,401 and above | 37% |

Considering Deductions and Contributions

Deductions and contributions, such as health insurance premiums, 401(k) contributions, and other benefits, significantly impact take-home pay. A Florida paycheck calculator allows users to input these deductions, providing a more accurate picture of their net income. For instance, an individual contributing 10% of their income to a 401(k) plan would see a reduction in their taxable income, thereby lowering their federal tax liability. Similarly, premiums paid for health insurance are deducted from the gross income, reducing the amount subject to taxation.

Payroll Frequency and Its Impact

The frequency of payroll—whether it’s weekly, biweekly, monthly, or semi-monthly—also affects take-home pay. A Florida paycheck calculator can accommodate different payroll frequencies, ensuring that calculations are adjusted accordingly. For example, an individual paid biweekly (every two weeks) would receive 26 paychecks in a year, as opposed to 24 paychecks for a semi-monthly pay schedule. This difference in payroll frequency can result in variations in take-home pay due to the timing of tax deductions and other withholdings.

Making Informed Financial Decisions

Perhaps one of the most significant benefits of using a Florida paycheck calculator is the ability to make informed financial decisions. By understanding exactly how much take-home pay to expect, individuals can better budget their expenses, plan for savings, and consider investments or additional income streams. This level of financial clarity is invaluable, allowing individuals to navigate the complexities of personal finance with confidence and precision.

How does a Florida paycheck calculator account for state taxes?

+Since Florida does not have a state income tax, the calculator focuses on federal taxes and other deductions to calculate take-home pay.

Can a Florida paycheck calculator be used for both employees and employers?

+Yes, the calculator can be beneficial for both parties. Employees can use it to understand their take-home pay, while employers can use it to ensure compliance with tax laws and to provide accurate pay stubs.

How often should I use a paycheck calculator?

+It's a good idea to use a paycheck calculator whenever your income, deductions, or tax status changes, as well as at the beginning of each year to account for any updates in tax laws or rates.

In conclusion, a Florida paycheck calculator is an indispensable tool for anyone looking to navigate the complexities of paycheck calculation in the state. By providing accurate and detailed breakdowns of take-home pay, considering taxes, deductions, and payroll frequency, this calculator empowers individuals and businesses to make informed financial decisions. Whether you’re a resident of Florida or an employer looking to ensure compliance with state and federal regulations, utilizing a Florida paycheck calculator can significantly simplify the process of managing finances and understanding the intricacies of payroll management.