For individuals looking to embark on a career in finance, the job market presents a myriad of opportunities across various sectors and disciplines. Entry-level finance jobs are designed to provide newcomers with the foundational experience and skills necessary to propel their careers forward. These positions are not only a stepping stone to more senior roles but also offer a comprehensive introduction to the financial industry, its operations, and its ethical considerations. The financial sector is known for its dynamism, with continuous evolution in financial instruments, technologies, and regulatory frameworks, making it an exciting and challenging field for those who are just starting out.

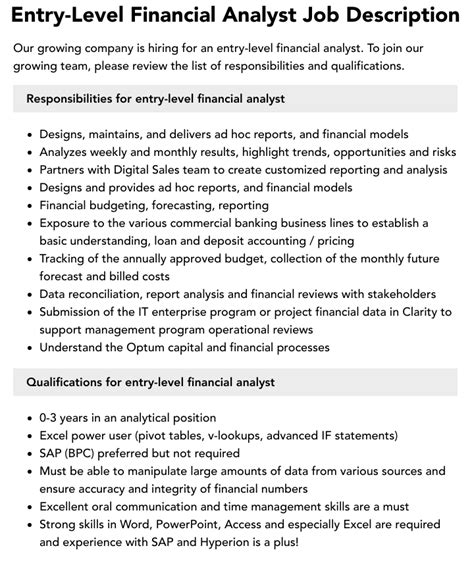

The diversity of entry-level finance jobs is quite broad, catering to different interests, skills, and educational backgrounds. From investment banking and asset management to financial analysis and planning, each role contributes uniquely to the functioning of the financial ecosystem. For instance, financial analysts are responsible for analyzing financial data and forecasts to help businesses and organizations make informed decisions. On the other hand, investment banking professionals assist clients in raising capital, advising on mergers and acquisitions, and managing financial assets. Understanding the responsibilities and requirements of each role is crucial for making an informed decision about which path to pursue.

Key Points

- Entry-level finance jobs offer a broad range of opportunities for career growth and development.

- Different roles within finance, such as financial analysis, investment banking, and asset management, require unique skill sets and knowledge bases.

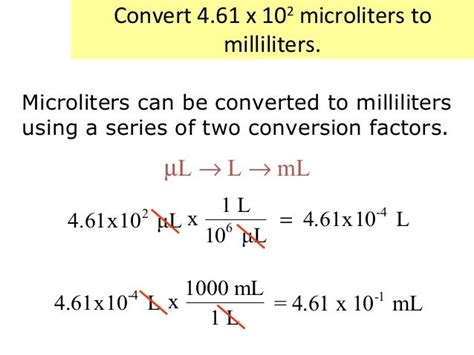

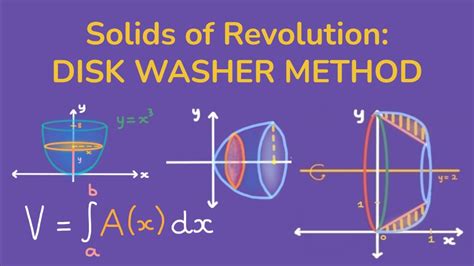

- Professionals in entry-level finance positions can expect to work in fast-paced environments, utilizing financial models, data analysis tools, and software to perform their duties.

- The financial industry is heavily regulated, and understanding ethical considerations and compliance is essential for success.

- Continuous learning and professional development are critical in the finance sector due to its dynamic nature and the constant evolution of financial technologies and practices.

Navigating Entry-Level Finance Jobs

Navigating the landscape of entry-level finance jobs requires a combination of academic preparation, practical skills, and a strategic approach to career development. Many entry-level positions require a bachelor’s degree in finance, economics, or a related field, though some roles may also consider candidates with degrees in mathematics, computer science, or business administration. Additionally, proficiency in financial software and tools, such as Excel, financial modeling programs, and data analysis platforms, is highly valued. Beyond technical skills, soft skills like communication, teamwork, and problem-solving are equally important, as they facilitate effective collaboration and client interaction.

Skills and Knowledge for Success

To succeed in entry-level finance jobs, individuals must possess a solid foundation in financial principles, including accounting, financial markets, corporate finance, and investments. The ability to analyze complex financial data, prepare forecasts, and develop strategic financial plans is also crucial. Furthermore, staying updated with industry trends, regulatory changes, and technological advancements is essential for providing innovative solutions and maintaining a competitive edge. Professional certifications, such as the Chartered Financial Analyst (CFA) designation, can also significantly enhance career prospects and demonstrate expertise in specific areas of finance.

| Finance Sector | Job Title | Key Responsibilities |

|---|---|---|

| Investment Banking | Financial Analyst | Financial modeling, data analysis, client presentation |

| Asset Management | Portfolio Manager | Investment strategy, risk management, portfolio optimization |

| Corporate Finance | Financial Planner | Financial forecasting, budgeting, strategic planning |

Industry Trends and Future Outlook

The financial industry is on the cusp of significant transformation, driven by technological innovation, changing consumer behaviors, and evolving regulatory environments. The integration of artificial intelligence, blockchain, and big data analytics is revolutionizing financial services, from payments and lending to investment and risk management. As a result, there is a growing demand for professionals with expertise in fintech, data science, and digital finance. Moreover, the emphasis on sustainability and environmental, social, and governance (ESG) factors is becoming more pronounced, requiring finance professionals to incorporate these considerations into their decision-making processes.

Despite the challenges posed by these changes, the outlook for entry-level finance jobs remains positive. The sector continues to attract talented individuals who are eager to contribute to its evolution and growth. By embracing the opportunities and challenges presented by the financial industry, newcomers can not only secure rewarding careers but also play a role in shaping the future of finance.

Strategic Career Development

Strategic career development is key to advancing in the finance industry. This involves setting clear career goals, seeking mentorship, and continuously updating one’s skills and knowledge to remain relevant. Networking is also vital, as it provides access to valuable advice, job opportunities, and industry insights. Furthermore, considering roles in emerging areas such as sustainable finance, digital assets, and financial technology can offer a competitive edge and open up new avenues for growth and specialization.

What skills are most in demand for entry-level finance jobs?

+Technical skills such as proficiency in Excel, financial modeling, and data analysis are highly valued. Additionally, soft skills like communication, problem-solving, and teamwork are essential for success in the finance industry.

How can I stay updated with industry trends and developments?

+Following financial news and publications, attending industry events, and participating in professional networks and forums are effective ways to stay informed about the latest trends and developments in finance.

What role does continuous learning play in a finance career?

+Continuous learning is crucial in the finance industry due to its dynamic nature. Pursuing professional certifications, participating in workshops and webinars, and engaging in self-study to update skills and knowledge are essential for career advancement and staying competitive.

In conclusion, entry-level finance jobs offer a gateway to a rewarding and challenging career in the financial sector. By understanding the requirements and opportunities of these roles, individuals can navigate their career paths effectively, contribute to the evolution of the finance industry, and achieve professional fulfillment. As the financial landscape continues to evolve, the demand for skilled, adaptable, and innovative professionals will only continue to grow, making this an exciting time to enter the field.