Florida, known as the Sunshine State, is a popular destination for tourists and a thriving hub for businesses. Understanding the state sales tax rates is essential for both individuals and companies operating within the state. The sales tax in Florida is a significant source of revenue for local governments and the state as a whole. In this article, we will delve into the specifics of Florida state sales tax rates, including how they are structured, the rates applied in different jurisdictions, and the types of goods and services that are subject to or exempt from sales tax.

Overview of Florida Sales Tax

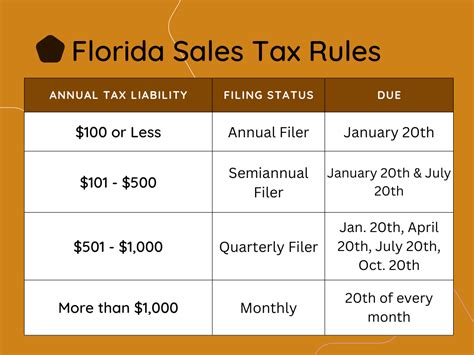

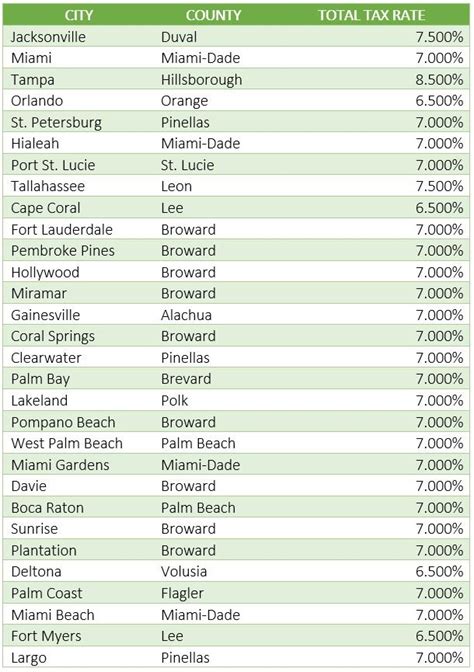

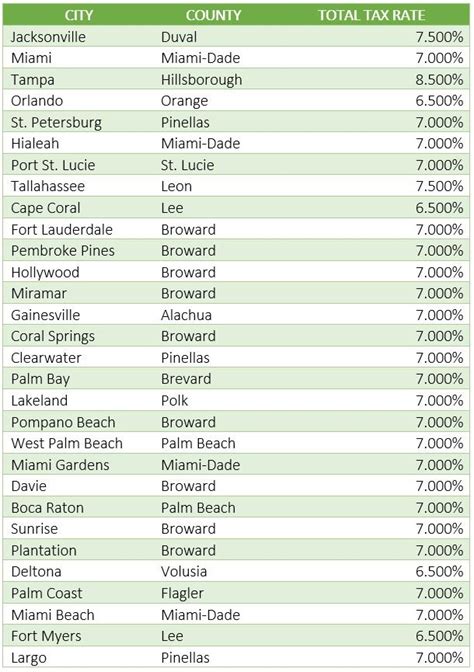

Florida imposes a state sales tax of 6% on the sale or rental of tangible personal property and certain services. However, it’s crucial to note that this rate can vary depending on the location within the state due to discretionary sales surtaxes imposed by counties. These surtaxes can range from 0.5% to 1.5%, depending on the county, which means the total sales tax rate paid by consumers can be anywhere from 6.5% to 7.5%.

County-Level Sales Surtaxes

Each county in Florida has the authority to impose its own discretionary sales surtax, which can be used to fund local projects and services. This means that businesses and individuals need to be aware of the specific sales tax rate in their county of operation or residence. For instance, Miami-Dade County has a total sales tax rate of 7% (6% state rate + 1% county surtax), while neighboring Broward County has a total rate of 7% as well (6% state rate + 1% county surtax). Understanding these rates is essential for accurate tax planning and compliance.

| County | State Sales Tax Rate | County Surtax Rate | Total Sales Tax Rate |

|---|---|---|---|

| Miami-Dade | 6% | 1% | 7% |

| Broward | 6% | 1% | 7% |

| Palm Beach | 6% | 0.5% | 6.5% |

| Hillsborough | 6% | 1% | 7% |

Exemptions and Special Considerations

Not all goods and services are subject to sales tax in Florida. Certain items, such as groceries, prescription medications, and medical devices, are exempt from sales tax. Additionally, Florida offers sales tax exemptions for specific industries or activities, such as manufacturing equipment and research and development expenses, to encourage economic growth and development.

Calculating Sales Tax

Calculating sales tax in Florida involves determining the total taxable amount of a sale or rental and then applying the appropriate sales tax rate. For businesses, it’s essential to maintain accurate records of sales, exemptions, and tax collected to ensure compliance with state and local tax laws. The Florida Department of Revenue provides resources and guidelines to help businesses navigate the sales tax system.

Key Points

- The state sales tax rate in Florida is 6%, with additional county surtaxes ranging from 0.5% to 1.5%.

- Certain goods and services, like groceries and prescription medications, are exempt from sales tax.

- Understanding local sales tax rates is crucial for businesses and individuals to ensure compliance and plan accordingly.

- The total sales tax rate varies by county, impacting consumer purchasing decisions and business operational costs.

- Accurate record-keeping and adherence to tax laws are essential for businesses to avoid penalties and fines.

In conclusion, navigating the Florida state sales tax rates requires an understanding of both the state and county-level tax structures. By recognizing the exemptions, surtaxes, and specific rates applied in different jurisdictions, businesses and individuals can better manage their tax obligations and make informed decisions. As the economy and tax laws evolve, staying informed about changes to sales tax rates and exemptions will be vital for anyone operating within the state.

What is the current state sales tax rate in Florida?

+The current state sales tax rate in Florida is 6%.

Do all counties in Florida have the same sales tax rate?

+No, counties in Florida can impose their own discretionary sales surtax, which ranges from 0.5% to 1.5%, making the total sales tax rate vary by county.

Are there any exemptions to the sales tax in Florida?

+Yes, certain goods and services, such as groceries, prescription medications, and medical devices, are exempt from sales tax in Florida.

Meta Description: Understand the Florida state sales tax rates, including the state rate, county surtaxes, exemptions, and how to calculate sales tax for compliance and planning.