The state of Florida has specific minimum salary requirements that apply to various employment situations, including exempt and non-exempt employees, as well as those in specific industries or occupations. Understanding these requirements is crucial for both employers and employees to ensure compliance with state and federal labor laws. In this article, we will delve into the details of Florida's minimum salary requirements, exploring the legal framework, exemptions, and industry-specific regulations.

Overview of Minimum Salary Requirements in Florida

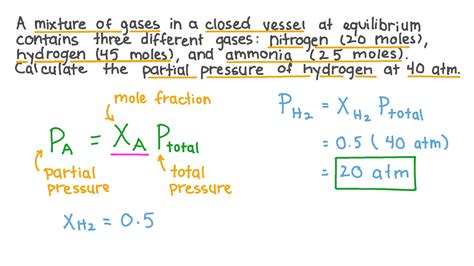

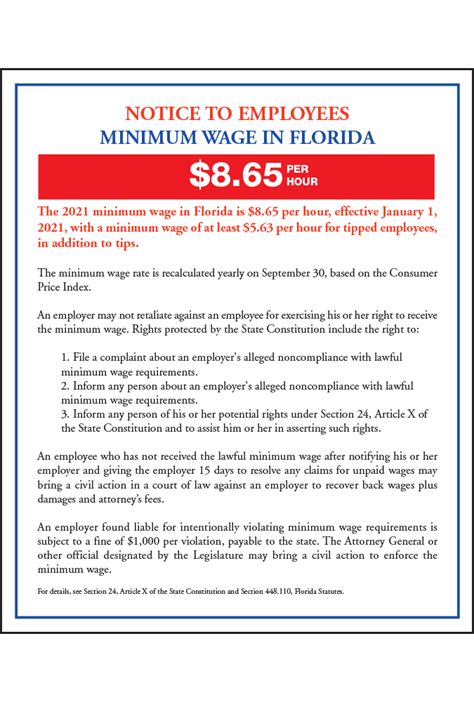

Florida’s minimum wage is adjusted annually for inflation, with the rate as of January 2023 being 10.00 per hour for non-tipped employees and 6.98 per hour for tipped employees, plus tips to reach the standard minimum wage. However, the concept of a “minimum salary” specifically refers to the threshold below which an employee cannot be considered exempt from overtime pay under certain exemptions, notably the executive, administrative, and professional exemptions under the Fair Labor Standards Act (FLSA). As of 2023, the FLSA requires that to qualify for these exemptions, employees must earn at least 684 per week, or 35,568 per year, although this does not directly apply to all types of employment in Florida.

Exemptions to Minimum Salary Requirements

Certain employees in Florida are exempt from minimum salary requirements, primarily due to their job duties, compensation structure, or industry-specific regulations. For example, outside sales employees, certain computer professionals, and highly compensated employees (who must earn at least 107,432 per year, with at least 684 per week paid on a salary or fee basis) are generally exempt from overtime pay. Additionally, some small businesses or organizations might be exempt from these requirements under specific conditions.

| Employee Type | Minimum Salary Requirement |

|---|---|

| Executive, Administrative, Professional | $35,568/year |

| Highly Compensated Employees | $107,432/year |

| Computer Professionals | Varies, but often exempt if meet specific duty tests |

| Outside Sales Employees | Generally exempt |

Industry-Specific Regulations and Considerations

Some industries in Florida have unique regulations and considerations regarding minimum salary requirements. For instance, the agricultural industry has its own set of rules, including specific exemptions for certain types of farmworkers. Healthcare professionals, including nurses and physicians, might have different considerations based on their employment status and the type of healthcare facility they work in. Understanding these industry-specific nuances is vital for compliance and fair labor practices.

Enforcement and Compliance

Enforcement of minimum salary requirements in Florida falls under the purview of both state and federal agencies, including the U.S. Department of Labor’s Wage and Hour Division and the Florida Department of Economic Opportunity. Employers found non-compliant with these regulations can face severe penalties, including back pay, fines, and legal action. Therefore, maintaining accurate records of employee compensation and ensuring that all employees are properly classified and compensated is essential for employers.

Key Points

- Florida's minimum wage is $10.00 per hour for non-tipped employees as of 2023, with specific rates for tipped employees.

- The FLSA sets a minimum salary requirement of $35,568 per year for certain exemptions, applicable to executive, administrative, and professional employees.

- Certain employees, such as outside sales employees and highly compensated employees, are exempt from these requirements under specific conditions.

- Industry-specific regulations, such as those for agricultural and healthcare workers, must be considered.

- Employers must ensure compliance with both state and federal labor laws to avoid penalties and legal issues.

In conclusion, navigating the complexities of minimum salary requirements in Florida requires a deep understanding of both state and federal labor laws, as well as industry-specific regulations. Employers and employees alike must be aware of these requirements to ensure fair labor practices and compliance with the law. As labor laws evolve, staying informed about the latest developments and adjustments to minimum salary requirements will be crucial for all parties involved.

What is the current minimum wage in Florida?

+As of 2023, the minimum wage in Florida is 10.00 per hour for non-tipped employees and 6.98 per hour for tipped employees, plus tips to reach the standard minimum wage.

Who is exempt from minimum salary requirements in Florida?

+Certain employees, such as outside sales employees, computer professionals, and highly compensated employees, are exempt from minimum salary requirements under specific conditions. Additionally, employees who meet the duty tests for executive, administrative, and professional exemptions and are paid at least $684 per week may also be exempt.

What are the penalties for non-compliance with minimum salary requirements?

+Employers found non-compliant with minimum salary requirements can face penalties, including back pay to affected employees, fines, and legal action. It is essential for employers to ensure compliance with both state and federal labor laws to avoid these consequences.